That's why we have this tool that permits you to enter your postal code as well as see what plans you can get. They do vary fairly a little bit from state to state. What You Required To Contrast, The very first things to recognize is what you need to contrast when it concerns states - car insured.

This is specified per crash as well as covers damage you do to residential property (not your very own lorry). This is what you insurer will cover for your injuries, as well as is specified each and also per mishap. This is defined each and per mishap, as well as covers you if you're included in an accident by a without insurance vehicle driver (insured car).

You can additionally get thorough insurance policy that covers your vehicle in events like storm damage, theft, and also extra - yet states don't need that. Also, note that the minimums might not suffice for you. You need to assess your own individual finance situation as well as see if you might require a lot more insurance policy.

If you do not wish to consider it, examine out, our primary referral for automobile insurance for university student. In about 10 minutes you can get your insurance coverage looked after online. Check out Allstate here.If you don't drive much, take into consideration using one of the alternate choices we provided (cars).

After USAA, the most affordable for students is State Farm. For coverage with this insurance firm, a high-school trainee will certainly pay an estimated $429 each month on average. The following 3 most inexpensive firms for high-school pupils are GEICO, Nationwide, and Allstate. University student, on the other hand, can expect to pay a bit much less for vehicle insurance.

9 Simple Techniques For Frequently Asked Questions - Sc Dhhs

One more terrific alternative for teens, students, and also new vehicle drivers is telematics. Telematics is brand-new modern technology and primarily contains an app that you download and install on your phone to track just how you drive. If the app considers you an excellent chauffeur, you will be qualified for substantial discounts. Keep in mind that not all insurance policy firms supply this choice.

Don't fail to remember to ask regarding discounts for vehicle safety and security functions. That will certainly help you get the cheapest rate. You can start with this tool from GEICO.

The ordinary expense of vehicle insurance coverage in the USA is $2,388 annually or $199 monthly, according to information from almost 100,000 insurance holders from Savvy. The state you live in, the level of protection you want to have, and also your sex, age, credit rating background, as well as driving history will certainly all factor into your costs (vehicle insurance).

Automobile insurance coverage have whole lots of moving components, as well as your costs, or the cost you'll pay for insurance coverage, is simply among them. Insurance is managed at the state degree, and regulations on needed insurance coverage and also rates are various in every state. Insurance provider take into consideration various variables, including the state and location where you live, along with your sex, age, driving history, as well as the level of coverage you would love to have.

Below are the biggest factors that will certainly influence the rate you'll spend for insurance coverage, and what to think about when taking a look at your automobile insurance policy choices. Keep in mind that there have actually been some big adjustments to car insurance coverage expenses throughout the coronavirus pandemic. Some cars and truck insurance providers are providing price cuts as Americans drive much less, and are additionally helping individuals influenced by the virus delay repayments (insurance companies).

How Much Does Car Insurance Cost For An 18-year-old In ... - The Facts

Company Expert put together a checklist of ordinary vehicle insurance policy costs for each state (insurance). Here's an array cars and truck insurance coverage prices by state.

As Well As from Business Insider's data, auto insurance policy business often tend to bill ladies extra. Company Expert collected quotes from Allstate and also State Ranch for standard insurance coverage for male and also female drivers with a the same profile in Austin, Texas - suvs. When exchanging out just the gender, the male profile was priced quote $1,069 for protection annually, while the women account was priced estimate $1,124 each year for insurance coverage, setting you back the lady chauffeur 5% more.

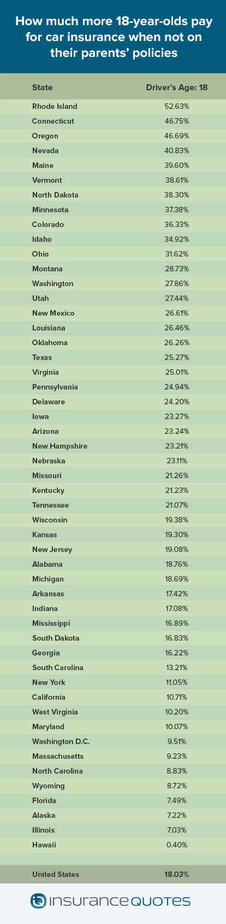

In states where X is a gender alternative on driver's licenses including Oregon, The golden state, Maine, as well as quickly New York insurance providers are still determining just how to compute prices. Average vehicle insurance premiums by age, The variety of years you've been driving will impact the price you'll pay for coverage. While an 18-year-old's insurance policy averages $2,667.

This information was supplied to Company Expert by Savvy. How vehicle insurance coverage rates change with the number of cars and trucks you possess, In some ways, it's sensible: the extra automobiles you have on your plan, the greater your auto insurance coverage costs (car insurance). There are additionally some cost savings when several autos are on one policy.

credit insurers insured car cheaper cars

credit insurers insured car cheaper cars

Cars and truck insurance policy is more affordable in postal code that are extra country, and the same holds true at the state degree. Insure. com information reveals that Iowa, Idaho, Wisconsin, as well as Maine have the most inexpensive car insurance policy of all states, as well as that's due to the fact that they're a lot more country states. Other variables that can impact the cost of automobile insurance coverage There are a few various other variables that will add to your premium, including: If you don't drive lots of miles annually, you're less likely to be entailed in a crash.

The 5-Minute Rule for Medicaid Eligibility - Nebraska Department Of Health And ...

Each insurance provider takes a look at every one of these aspects and also prices your protection differently consequently. insurers. It's crucial to compare what you're provided. Get quotes from several different auto insurer and also compare them to ensure you're obtaining the most effective bargain for you. Personal Money Reporter.

Similar to insuring any type of other lorry, insuring a motorcycle sets you back a lot more when you're less than 25 years of ages. If you're 18 years old, you can anticipate the expense of insurance policy to be substantially more than it would for an older grownup. The ordinary motorcycle insurance policy expense for an 18-year-old is $998 annually.

Allow's take a better look at these expenses, the aspects that impact them, and also exactly how you can conserve money on motorbike insurance policy. How Much Does Motorbike Insurance Policy Price?

We have actually placed together several of them, so you can much better understand what goes right into comprehending your motorbike insurance expenses. This will certainly get you a more affordable plan, but it will just cover damage to other lorries or pedestrians.

To get coverage for your bike, you'll require crash and detailed coverage, which can set you back substantially much more. An additional protection choice that influences your rate is your insurance deductible.

Not known Facts About Millennial Couple Earns $6 Million A Year From Youtube And ...

However, a higher insurance deductible methods you'll be on the hook for even more cash if you get in a mishap Location As we currently pointed out, your area can have a substantial result on your price. The most vital element here is the temperature. In cooler states, the riding period is shorter, while it can last all year in warmer areas.

cheapest auto insurance car insurance car insurance prices

cheapest auto insurance car insurance car insurance prices

Enjoyment cyclists will pay much less than commuters. Some insurance providers will certainly additionally inquire about your annual gas mileage. This can likewise have an impact on your rates. The more you ride, the extra you pay. Speeding as well as Website Traffic Tickets Equally as with auto insurance, your motorcycle insurance will increase if you have a record of speeding as well as various other violations.

The good news is, in the majority of states, the majority of offenses diminish your document after 3 years. Keep your nose clean for some time, and your prices will certainly go down. Need details on state-by-state motorbike legislations? Click right here. Crash as well as Insurance Claim History If you have actually just recently been in a mishap, your insurance coverage rates will certainly increase. vehicle.

Credit rating Most insurance firms run a debt check as part of offering a quote. An excellent credit report ranking will certainly get you lower rates than a poor debt score. As well as an insurance policy quote won't count as a "tough check", so it will not affect your Discover more credit scores rating. How to Minimize Motorcycle Insurance policy One of the most crucial point to do when getting motorbike insurance is to contrast prices from different firms.

Typically, insurance policy firms have actually covered mopeds and also mobility scooters under their bike insurance policies. The average scooter insurance policy expense is about $250 per year.

About Medicaid Faq - Delaware Health And Social Services

Exactly How Much Is Vehicle Insurance monthly? Chauffeurs in the USA invest approximately $1,251 per year2 on car insurance, making the ordinary cars and truck insurance policy expense monthly $104. This typical rate is based on a complete protection policy for a motorist under 65 years of ages that has greater than six years of driving experience as well as a tidy driving record.

We've gained an online reputation for integrity and count on, and also we're happy to have a document of high customer scores for claims services. If you live in a location where your threat of being in an accident is higher, your insurance policy rates might be greater.

Below are a couple of variables that will impact your insurance quotes: Driving history Credit history ratings Age Zip Code Auto Insurance Policy Company Average Month-to-month Expense of Auto Insurance Coverage by Automobile Kind The sort of vehicle you drive can also affect your auto insurance rate. Sometimes, automobile insurer may bill extra for insurance coverage on particular kinds of automobiles, including: Owning a cars and truck that is generally stolen can mean that your thorough insurance prices are higher.

These sorts of autos are usually much more costly to fix if they are damaged. In the situation of deluxe automobiles, they're typically much more pricey to replace if they're totaled from a vehicle mishap (cheap auto insurance). Since these vehicles can travel at higher rates, individuals may drive them quicker and also be more probable to obtain in a crash or receive a traffic infraction.

laws vehicle credit score cheapest car

laws vehicle credit score cheapest car

Vehicle drivers under 25 have much less experience when traveling and also research studies reveal they cause extra mishaps (affordable car insurance). 3 So, if you or somebody on your policy is under 25 years of ages, your cars and truck insurance coverage costs might be greater. Auto insurance coverage prices may reduce after a vehicle driver turns 25, particularly if they have not had any at-fault crashes.

Medicaid Eligibility - Nebraska Department Of Health And ... - An Overview

Usually, if you more than 25 however below 60 years old, your vehicle insurance price monthly will be the most affordable. If you're not within that age variety, you can still find ways to conserve. Actually, we offer several special rates as well as discounts with the AARP Automobile Insurance Policy Program from The Hartford.

If you have an AARP subscription, obtain a car insurance quote today as well as conserve. Just how Much Is the Ordinary Automobile Insurance Coverage per Month in My State?

One state's typical vehicle insurance policy expense per month might be higher than another's because it calls for motorists to have even more obligation insurance coverage. On the various other hand, one more state might average the cheapest auto insurance per month because it calls for a lower minimum insurance coverage.